Company line of credit history (LOC): For brief-term financing, an LOC is usually helpful. It will allow your company to borrow money as desired and pay back them back again after a while just like a credit card. A LOC generally calls for collateral and has a better curiosity level than other sorts of loans.

An LLC operating agreement is actually a authorized doc that outlines the ownership structure and member roles of an LLC.

Create an functioning arrangement: Based on where you reside, you may or may not need an working arrangement to ascertain an LLC. You might not be required to file your working arrangement Along with the point out.

Many doctors' groups are registered as LLCs. This allows protect the person Health professionals from individual liability for professional medical malpractice awards.

The gives that look In this particular table are from partnerships from which Investopedia gets payment. This compensation may well influence how and exactly where listings appear. Investopedia does not consist of all delivers available from the marketplace.

What exactly is a C Corp? Definition, Pros & Cons, and Taxes A C corporation is really a company whose owners or shareholders are taxed individually through the corporation itself, and whose income are taxed on both equally a company and a private amount.

Consider your market, the volume of members, and the desired standard of liability defense when choosing the ideal LLC construction for your online business. Thorough arranging and evaluation of your business targets will guide you towards the most fitted construction to your venture.

With the electronic entire world's evolution, a domain title matching your LLC's title performs a pivotal purpose in building a robust online presence.

By having an LLC, a business continuation agreement can be employed to make sure The graceful transfer of passions when one of several homeowners leaves or dies. Devoid of this sort of an agreement set up, the remaining partners must dissolve the LLC and create a brand new 1.

Trustworthiness. Forming an LLC to personal and operate your small business can help Present you with trustworthiness. It reassures buyers that yours is a real organization. You can even have an official enterprise identify to employ.

Distributive shares consult with Each individual member's share of your LLC's income. Customers need to report this sum on their own own money and tax returns. The IRS testimonials each member's tax return to ensure that LLC members report their cash flow correctly.

Simply because only LLC belongings are accustomed to pay back business enterprise debts, LLC house owners stand to get rid of only The cash that they've invested while in the LLC.

To create your LLC, You will need to file content articles of Corporation using your condition. The article content could be identified as another thing in the point out, like posts of Open an LLC formation, Nonetheless they're all exactly the same point.

The functioning settlement should really define the powers and obligations of your LLC's associates and supervisors, the distribution of income and losses, and also the treatments for buyouts or dissolutions.

Angus T. Jones Then & Now!

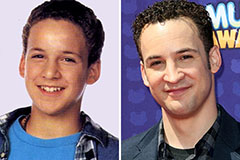

Angus T. Jones Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!